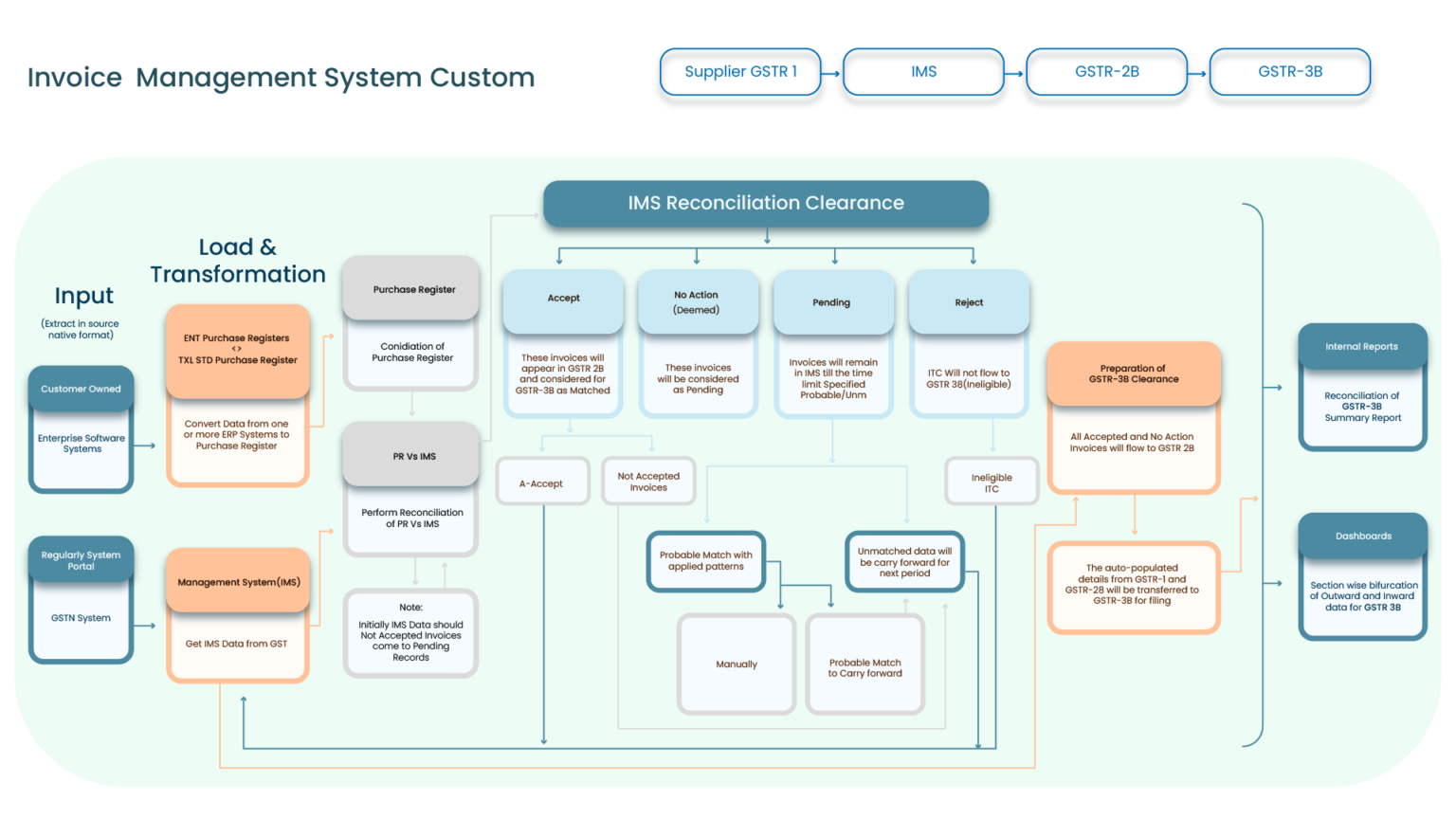

What is an Invoice Management System (IMS) API?

An IMS API helps businesses automate their invoice workflows from data ingestion to reconciliation and GSTR-1 validation. It ensures GST compliance, real-time API calls, and seamless integration with your ERP or finance systems.